At UBRIS, we understand that building a business means mastering the delicate balance between operations, strategy, and finance. Our Top 10 financial design services focus on helping businesses like yours navigate the complexities of financial management with clarity and precision. Whether you’re looking to streamline your cash flow, develop effective tax strategies, or structure your business for growth, our approach is tailored to meet your unique challenges.

We dive deep into your business’s financial story, identifying opportunities to enhance profitability, manage risk, and plan for sustainable expansion. From strategic financial planning and optimizing day-to-day operations to ensuring compliance and effective investment strategies, each of our Top 10 services is designed to provide your business with the financial foundation it needs to thrive.

Financial strategy

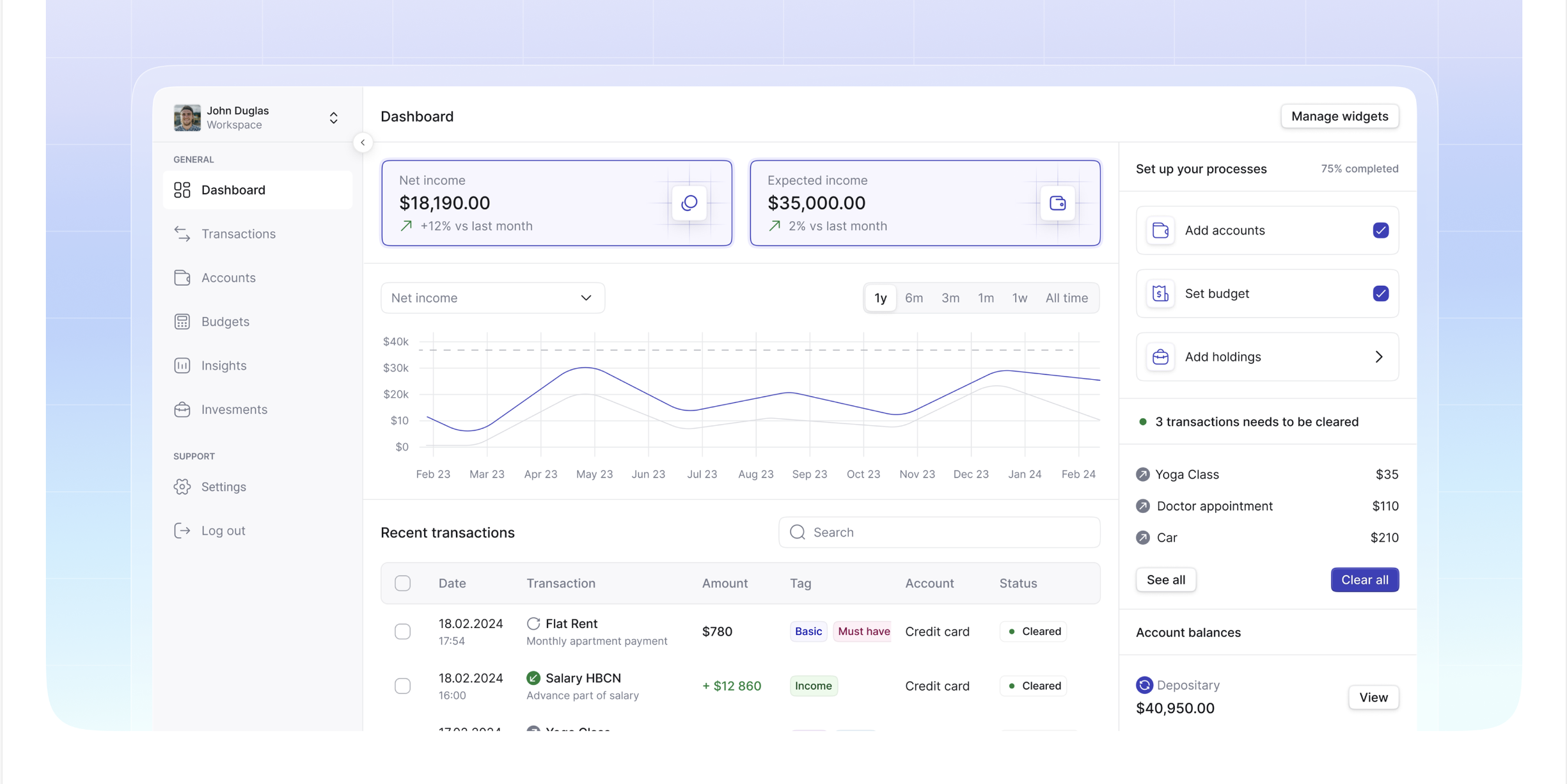

Financial planning and forecasting

Cash flow management

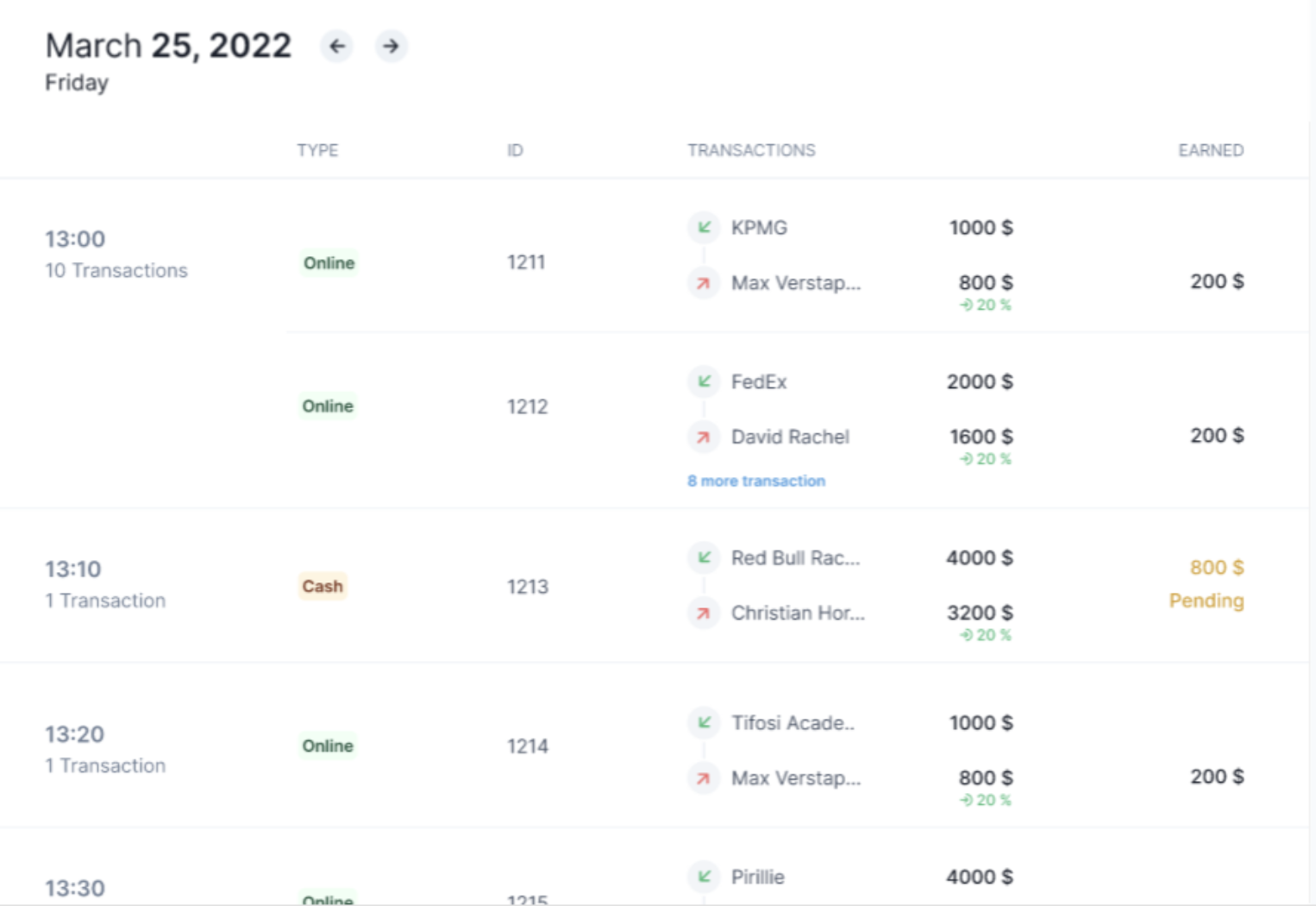

Bookkeeping and accounting systems

Tax planning and compliance

Business structuring and growth strategies

Financial planning and forecasting: We help you map out the future of your business, creating tailored financial plans and forecasts to set clear, achievable goals for revenue, profit, and cash flow. With our guidance, you’ll have a strategic roadmap that ensures growth and sustainability.

Cash flow management: Maintaining healthy cash flow is essential to your business. We work with you to optimize cash management, from improving billing cycles to reducing expenses, ensuring your business has the liquidity it needs to thrive and grow.

Bookkeeping and accounting systems: Setting up efficient accounting systems is the backbone of financial success. We help implement the right tools and processes, providing you with accurate financial data to make informed decisions and keep your business running smoothly.

Tax planning and compliance: Navigating tax obligations can be complex. We simplify the process, ensuring that your business is compliant with all tax laws while identifying strategies to minimize liabilities and maximize savings.

Business structuring and growth strategies: As your business evolves, so should your structure. We advise on the most advantageous business setup, ensuring that your organization is built for scalability and future success.

Cost management

Debt management

Profitability and pricing strategies

Risk management and insurance

Investment planning

Cost management: Keeping your operational costs under control is crucial for profitability. We help you identify cost-saving opportunities and ensure you get the best value from every dollar spent, without compromising on quality or efficiency.

Debt management: Managing debt strategically is key to financial stability. We work with you to reduce debt, restructure financing, and improve the way you manage interest payments, so your business can move forward with confidence.

Profitability and pricing strategies: Setting the right price is critical to your business’s success. We analyze your margins and help you develop pricing strategies that ensure profitability while remaining competitive in the market.

Risk management and insurance: Your business deserves protection from potential risks. We assess your financial risks and recommend the right insurance solutions, giving you peace of mind as you navigate growth and change.

Investment planning: When it’s time to invest in your business, we’re here to help. Whether it’s reinvesting profits or seeking new opportunities, we provide strategic advice that aligns with your goals and maximizes your returns.

Igniting innovation through visionary design and strategic brilliance.